Rental Income Guarantee Scheme Designed to Facilitate Growth

The official launch by the Scottish Futures Trust (SFT) of the Scottish Government’s Private Rental Sector, Rental Income Guarantee Scheme (RIGS) is timely and should be well received by all those involved in Build to Rent developments in Scotland.

The guarantee was born out of extensive consultation with the industry, including the housebuilding industry body, Homes for Scotland, and is designed to tackle a key area of risk for Build to Rent investors – the initial rent stabilisation period. Given this is an emerging sector, there can often be uncertainty around the level of rental income in the early years of operation. The RIGS deals with this issue by providing either a three or five-year guarantee.

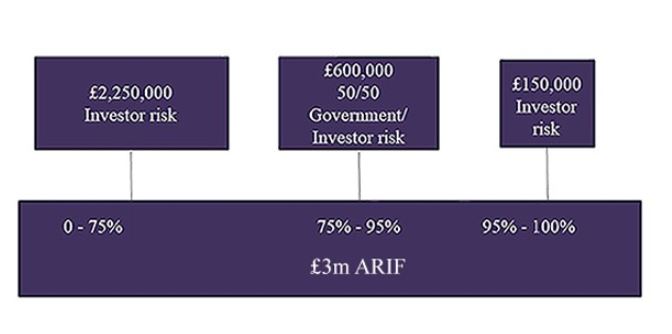

Under the guarantee, the Scottish Government underwrites 50% of any shortfall in rental income between 75% and 95% of the agreed annual core rental income forecast (ARIF). The ARIF will be set at the point the guarantee is entered into.

The annual cost of the guarantee will be 1.22% of the ARIF and the illustration above shows the risk profile for a project with an ARIF of £3m.

The RIGS is billed as a “key component of a wider set of measures and positive interventions designed to facilitate the growth of the Build to Rent sector in Scotland”. It was launched along with the Scottish Government commissioned publication – The Build to Rent Opportunity in Scotland, part of the “Building the Private Rented Sector” project that was initiated by Homes for Scotland.

Here at Burness Paull we are at the forefront of the Build to Rent market in Scotland, having worked with the SFT in formulating and drafting the RIGS document, and having acted for developers, investors, and landowners in the first wave of Build to Rent schemes in Scotland, we are delighted to see the Scottish Government’s positive engagement with this sector. The RIGS, along with the exemption of the 3% LBTT Additional Dwelling Supplement on sales of more than six residential properties (a significant tax advantage when compared with the position in England), are concrete examples of the Scottish Government putting its money where its mouth is. That said, amidst the positive message this sends to the sector, it is unlikely to be the magic wand that will bring investment flooding into Scotland, but it is a step in the right direction. The RIGS is managed and administrated by the SFT from start to finish.