Insights & Events

Events - 8th May 2024

RSVP here for this year's IP and Technology Conference.

Events - 7th May 2024

Our webinar series will consider key data protection compliance requirements and emerging trends.

Events - 18th April 2024

Join us for our Mock Employment Tribunal where we bring the process to life, live on stage.

Insights - 18th April 2024

Key changes The Bill, if enacted, would bring and what happens next in the parliamentary process.

News - 12th April 2024

Burness Paull wins "Scotland IP Disputes Firm of the Year" at Managing IP EMEA Awards 2024.

Insights - 11th April 2024

The draft Housing (Scotland) Bill has been published and laid before the Scottish Parliament.

Insights - 10th April 2024

Seafarer's employment rights: The recent case of the Yacht Management Company Ltd v Gordon.

Insights - 8th April 2024

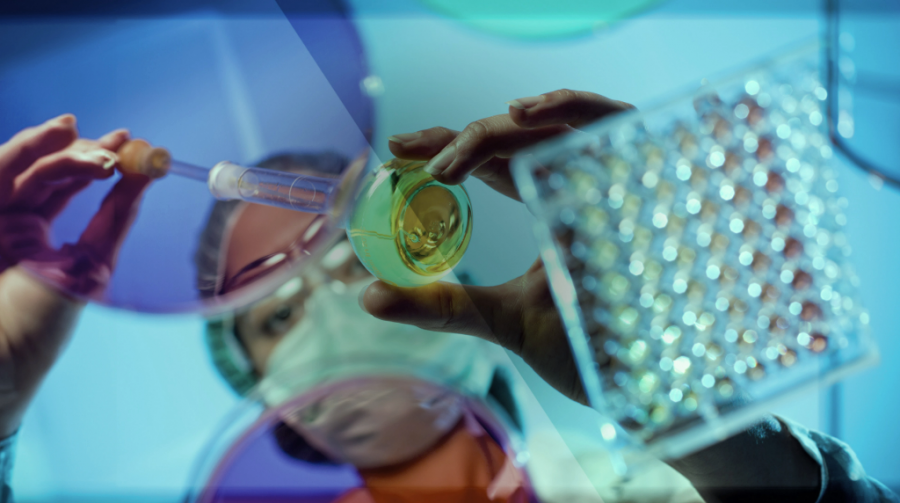

Explore the key trends across Life Sciences, Health & Care and MedTech